td ameritrade taxes explained

Traders said that TD Ameritrade retail risk closed my account that is even current users were deprived of access. For instance traders with a TD Ameritrade or Charles Schwab account may be able to trade futures while traders with a Fidelity or Robinhood account cannot trade futures.

Td Ameritrade Review Is It The Best For Beginners

In many cases securities in your account can act as collateral for the margin loan.

. This can be anywhere from 15 to 35. Checking your credit reports is the best way to see if old debts are still lingering. Fidelity wired the initial funds today then immediately issued a margin call.

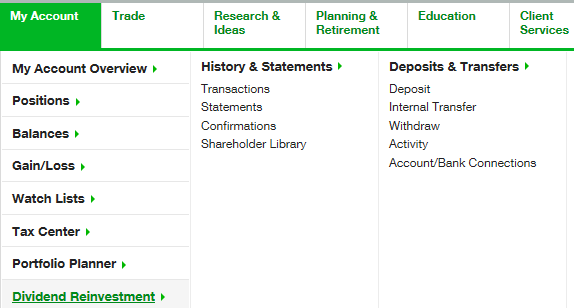

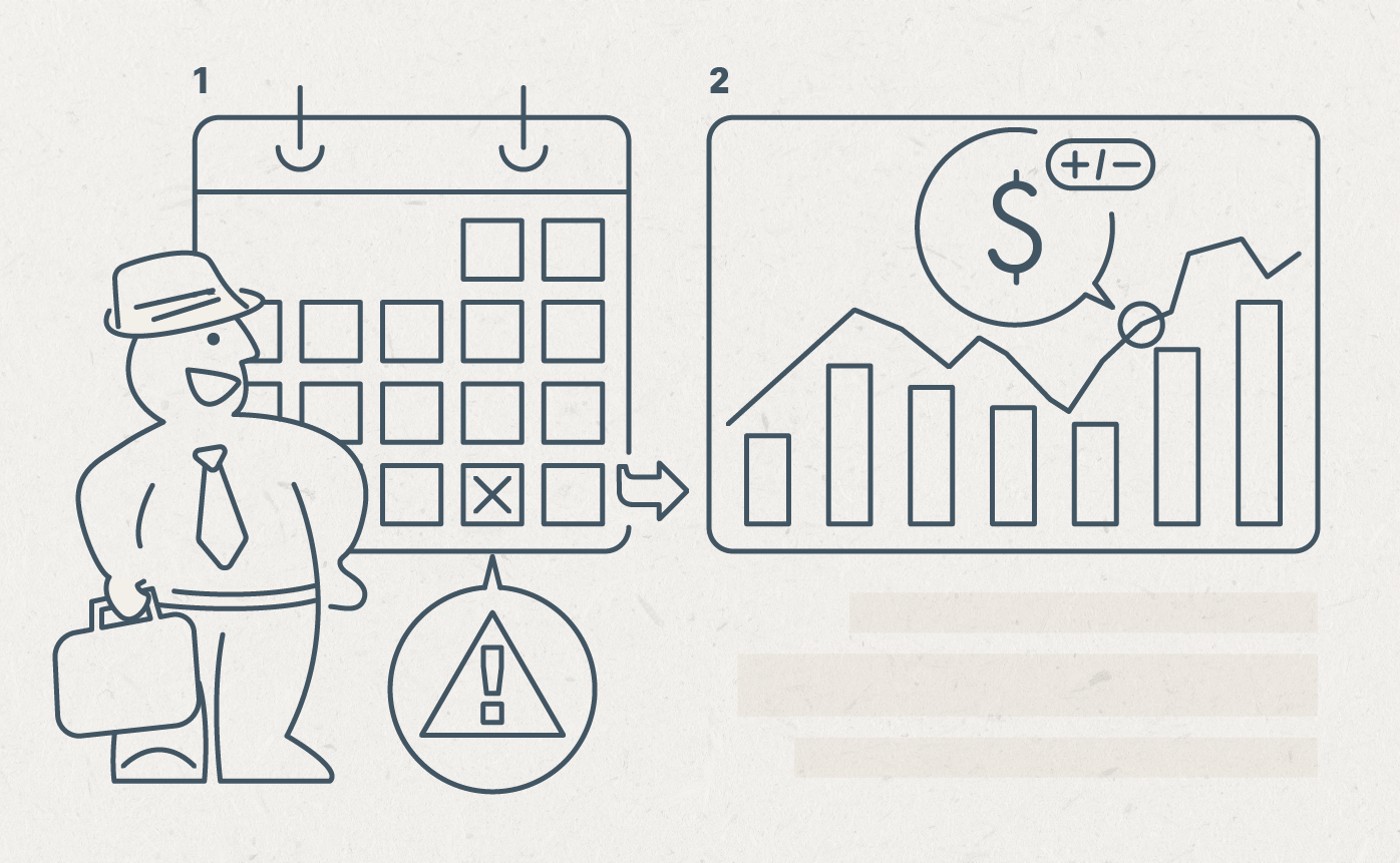

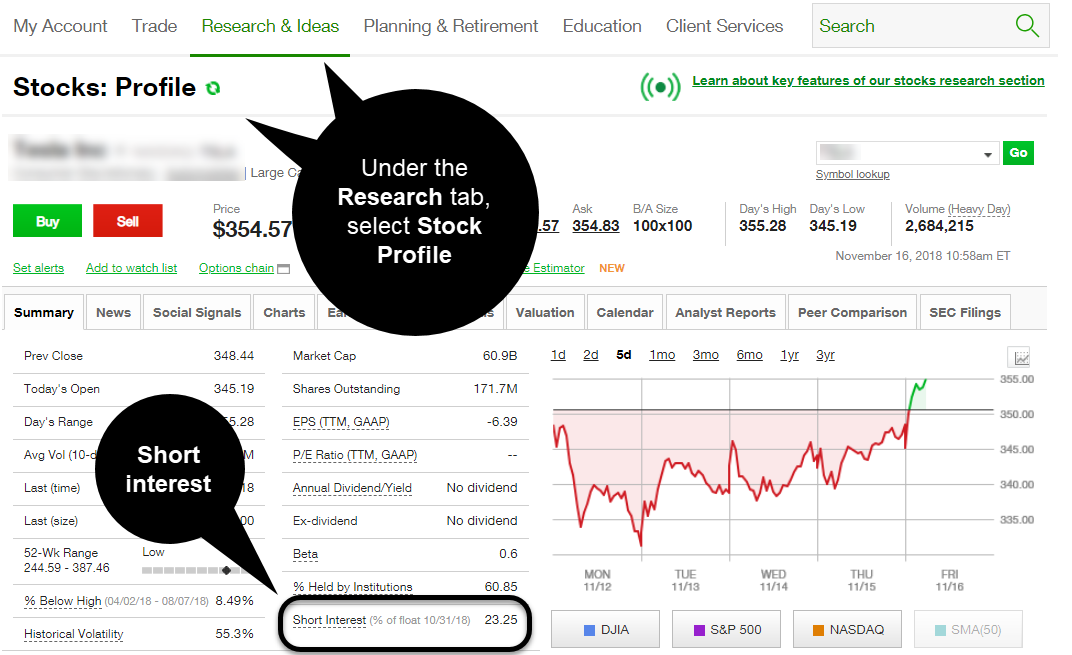

Here you can find the stocks historical performance analyst ratings company earnings and other helpful information to consider when selling a stock. To avoid this happening week after week which Ive spent hours on so far I today decided to move the funds in my account to my account at TD Ameritrade then liquidate the remaining securities over the next week or so and have that money wired. The pattern day trading rule is simple when explained through examples.

The percentage of individuals viewing a web page who click on a specific advertisement that appears on the page. The amount of taxes paid is based on income. How To Complete Form 945.

First what is an ETF. Get a taste of our articles videos events and moreAnd if youre looking to practice we even offer risk-free trading with thinkorswims simulated trading program paperMoney. The brackets adjusted slightly upwards for 2022.

Examples Of Pattern Day Trading. Click-Through Rate CTR. Taxes Tax Planning.

In general an exchange-traded fund ETF combines a variety of securities in one unit some call it a basket of assets like stocks bonds and other securities. However the foreign home country may withhold some percentage of the dividend as tax. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day.

Navigate to the stocks detail page. Quantitative easingQE for shortis a monetary policy strategy used by central banks like the Federal Reserve. ADRs follow the same taxation rules as traditional stocks.

Lets imagine Sarah has opened a margin account with 1000. Below the percentage of taxes paid are listed on the left with the corresponding income on the right. HSAs or Health Savings Accounts save on taxes health care costs.

Since Emancipation Day is a Washington holiday and. If youre a landlord filing your taxes can be a bit confusing. Margin interest rates vary among brokerages.

Long-term gains are those on assets held for over a year. Most major tax software makes filing a Schedule E very simple - and if you use the same tax software from year to year it will easily allow you to keep track of your depreciation and more. As the IRS explained in its recent press release Washington DC holidays affect the tax deadline.

Our free immersive education can help you hone your options trading skills and techniques. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company Inc. Best Free Tax Software.

Rarely do you start a new job on January 1st or end it on December 31st. Filing Your Taxes. PhD is an experienced business writer and teacher who has been writing for The Balance on US.

Its no longer a risk-defined trade. Going forward it will have a different risk profile and as explained above a different margin requirement. Luckily the IRS offers tax credits so your dividend doesnt get double-taxed.

And Accretive Capital LLC are. A TD Ameritrade account thats approved for margin trading must have at least 2000 in cash equity or eligible securities and a minimum of 30 of its total value as equity at all times. Click-through rate measures how successful an ad has been.

Pattern Day Trading Rules Explained. With QE a central bank purchases securities in an attempt to reduce interest. TradeStation and Scottrade may impose greater daily trading limits than Interactive Brokers and TD Ameritrade for example.

When you gain and lose access to a high deductible health plan will impact your. If you are pattern day trading with sufficient capital when filing your taxes you may find you qualify for Trader Tax Status TTS. And The Toronto-Dominion Bank.

Schedule E Explained. But that doesnt mean you cant do this yourself. Business law and taxes since 2008.

However even if your brokerage offers futures trading you will likely need to open a special margin or futures account to trade with. Two other major costs to consider when investing in index funds are the tax-cost ratio which refers to the amount of taxes you pay based on distributions compared to your returns as well as the. SPY may have been the first ETF but many have followed in its wake.

IRS guidelines for the 2022 HSA contribution limits and other HSA rules. The platforms founders explained this decision because Thinkorswims activities violate the legal requirements of other states. This means youll pay taxes on any dividend payment you receive.

Whether Over or Under 25k Pattern trading rules may apply to your cash account. Types of Vision Insurance Explained How to Find Cheap Dental and Vision Insurance. Pro-Rated Contribution Rules Explained.

She has taught accounting business law and business finance at business and professional schools for over 35 years has. However users quickly enough found ways to register in the system bypassing this ban. Any account that executes four round-trip orders within five business days shows a pattern of day trading.

Td Ameritrade Review Is It The Best For Beginners

Volume As An Indicator Why You Should Listen To It Ticker Tape

Options Exercise Assignment And More A Beginner S Ticker Tape

Transferring Funds Td Ameritrade Mobile Iphone Youtube

The Short And Long Of It Your Top Questions On Short Ticker Tape

It S Harvest Time Potentially Grow Your Savings Usin Ticker Tape

It S Harvest Time Potentially Grow Your Savings Usin Ticker Tape

Td Ameritrade Review Is It The Best For Beginners

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

Options Exercise Assignment And More A Beginner S Ticker Tape

Options Exercise Assignment And More A Beginner S Ticker Tape

Td Ameritrade Review Is It The Best For Beginners

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape